As the global economy continues to adjust to a quickly changing landscape there’s one truth across every industry: Companies need robust payment functionality to grow and compete in today’s global market. In addition to geographic differences, international digital payments are evolving to include a diverse range of payment methods, such as digital wallets, bank transfers and Buy Now, Pay Later.

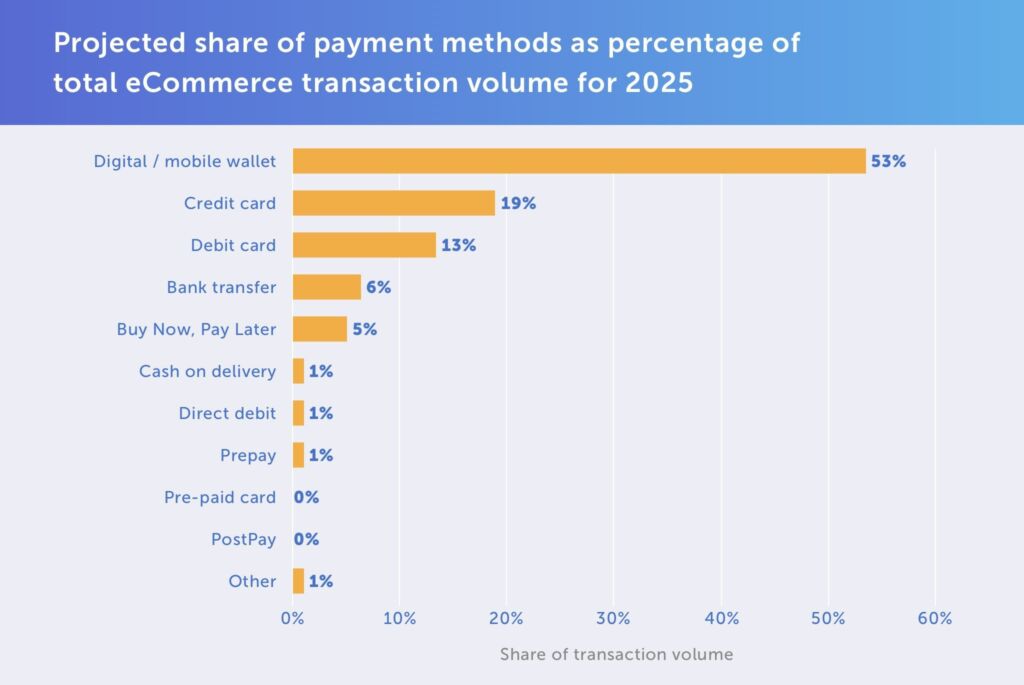

With digital and mobile wallets estimated to account for over half of all eCommerce payment transactions, businesses need to continually add new functionality to meet their customers’ preferred payment methods. And this compounds as you expand into new geographies. Each region may have its own payment methods, tax and regulatory factors that need to be considered. And with each new currency or payment method comes the need for maintenance and the associated operational headaches and drains on resources.

You might assume you need to work with multiple vendors to support all your payment requirements, especially as you scale, but that doesn’t have to be the case. A payment orchestration platform can provide you with a single solution for managing all aspects of payments from end to end.

What Is Payment Orchestration?

Benefits of Payment Orchestration

Payment Orchestration Use Cases

Get Started with a Payments Orchestration Provider

What Is Payment Orchestration?

If you can picture all your supported payment methods, acquirers, eCommerce features and related services as a symphony, then a payment orchestration platform is the conductor, allowing you to activate and utilize features as needed, by country, by product, by issuer and more. It is the back-end infrastructure that integrates, directs and handles the different service providers, acquirers and banks that support payments through a single platform.

Payment orchestration is designed to provide you with more control over the important elements of your payment stack from end-to-end, allowing you to turn them on or off as you need them. Common elements include:

|

|

|

This incredibly powerful, single control layer is made possible through cloud infrastructure in combination with robust APIs that are heavily customizable and flexible enough to allow for easy integration.

Benefits of Payment Orchestration

When you use a payment orchestration platform to support your business, you can start seeing immediate benefits:

- Reduced Integration Complexity: By choosing a single, flexible provider that can meet your payment needs now and as you scale, you’ll simplify your maintenance and allow your development resources to focus on more value-added work.

- Better Scalability: If your payment orchestration platform already has everything needed for global payments built in, then it will be able to support your business as it grows into new business models or geographies.

- Greater Insights: Having a unified and centralized system for all your end-to-end information results in a more robust amount of aggregated data analytics, which means you get more accurate insights into all aspects of your business.

- Payment Optimization: Having all your payments in a single robust system means that all of your payment processing can leverage the same tools for optimization, which can include intelligent payment routing, tokenization, local card acquiring and more. This reduces the risk of failed transactions, improving your authorization rates and reducing your costs.

- Improved Customer Experience: More payment options and localized experiences means less friction at checkout for your customers. If your customers can easily complete their purchase, they will come back and do it again.

The best payment orchestration platform offers more than helpful features. They offer payments expertise. Changes in digital payments and eCommerce continue to accelerate, so being able to draw upon a payment orchestrator’s expertise ensures you will be able to continually innovate your payments, compliance and global capabilities for today and the future.

Payment Orchestration Use Cases

Payment orchestration can provide your business with robust features that support how you want to accept payments. An exemplary payment orchestration platform should be flexible enough to allow you the ability to turn aspects of these features on and off as needed, even if for a specific country or product.

With a payment orchestration platform:

- An online marketplace can onboard vendors and set up customized payouts and schedules no matter the country of origin or payment method used.

- Companies looking to expand into new regions can immediately start processing cross-border payments with local card acquiring, the right currencies and payment methods, and meet local compliance requirements without the need to invest in additional payment solutions or integrations.

- A merchant that sells both direct to consumer and B2B can get the capabilities needed to accept cards, digital wallets and alternative payment methods while also having the technology to digitalize their accounts receivable processes and process invoice payments online through a single integration.

- SaaS providers can embed payments in their platforms to meet their customers’ payment processing needs while also creating a new source of revenue for the business. They can even use the same platform for processing invoices and payments for their own collections.

No matter your needs, you’ll want to look for a payment orchestration platform that has the functionality to support all these unique payment requirements.

Get Started with a Payment Orchestration Provider

When considering a payment orchestrator or payment orchestration platform for your business, here’s what you’ll want to be sure is incorporated:

- Payment Optimization: Look for a payment orchestration platform designed to help you get the most out of your payments. This means increasing your authorization rates with features like intelligent payment routing, network tokenization, 3-D Secure and fraud Through our payment optimization process our customers see a 1% to 3% increase in their authorization rate for domestic payments and an impressive 10% to 13% for cross-border transactions.

- Cross-Border Payment Functionality: When you sell online, you want to ensure that you can reach the global marketplace. Even if you don’t sell into other regions today, this is an important area of future growth you can’t overlook. Through one integration with BlueSnap you get access to 100+ currencies, 100+ of the world’s preferred payment types and 29 languages, allowing you to easily sell in over 200 regions.

- Beyond the Transaction: The right platform should have all the tools you need to manage your payments, including fraud prevention that blocks fraud but allows more valid payments through, chargeback management to help you recover revenue and built-in tools to help you stay in compliance no matter where you sell.

- Unified Reporting: You should always be tracking the metrics that matter most for your business growth. Connect our Reporting API to your core business systems so you can call the data you need when you need it. Our out-of-the-box reporting and analytics capabilities allow you to dive right into the eCommerce data that drives your business to generate the insights to boost conversions.

- Application Integrations: Adopting a payment orchestration platform doesn’t mean you need to delete all your existing applications. Simple platform integration means you can easily integrate our payment platform into hundreds of popular software services like Salesforce, NetSuite or QuickBooks.

- Payments Expertise & Support: Look for a payments partner that understands the needs of your clients as well as your platform and has extensive experience with a wide range of tech stacks. That partner should be able to:

- Offer guidance to help you incorporate payments in a holistic way that enables you to grow.

- Be flexible in meeting your needs, providing a choice of the functionalities that you need without obligating you to ones you don’t.

- Assist you in considering how you can effectively integrate the payment platform into your internal organization.

- Quickly migrate your existing customer portfolio to get them up and running without issue.

If you want to prioritize solutions that allow you more flexibility, control and scalability, consider BlueSnap’s Payment Orchestration Platform. Whether you’re a marketplace, a merchant selling direct, embedding payments within your platform or using our AR automation software, you’ll benefit from a solution that’s robust enough to support growing your business with a single integration — no matter how the payment landscape changes.

Related Resources: