Built-In Payments Compliance Solutions to Reduce Your Risk

Global Payments Compliance Solutions Built-In

Data security and compliance shouldn’t slow down or endanger your business. Providing a compliant payments platform is directly correlated to business success. The cost of operating a platform that does not meet regulatory compliance can lead to costly fines, reputation damage, revenue loss and business disruption. But with BlueSnap, you’re covered. Our platform is fully compliant with all privacy, security and card scheme rules so you know your business complies with industry standards. Plus, we have built-in tax solutions to help you meet regional requirements.

10M

euros is the cost in GDPR fines for non-compliance alone. That can be devastating to a business. At BlueSnap, we give you the tools and expertise to stay in compliance with this and other regulations.

Don’t Let Non-Compliance Interrupt Your Business

Avoid Costly Fees

Run Smoothly

Sell Globally

Improve Reputation

We Solve Compliance for You

BlueSnap checks all the boxes when it comes to complying with requirements like PCI-DSS Compliance, GDPR, PSD2 and tax regulations, helping you meet the highest industry standards. Failure to comply can result in fines, business disruptions and damage to your reputation.

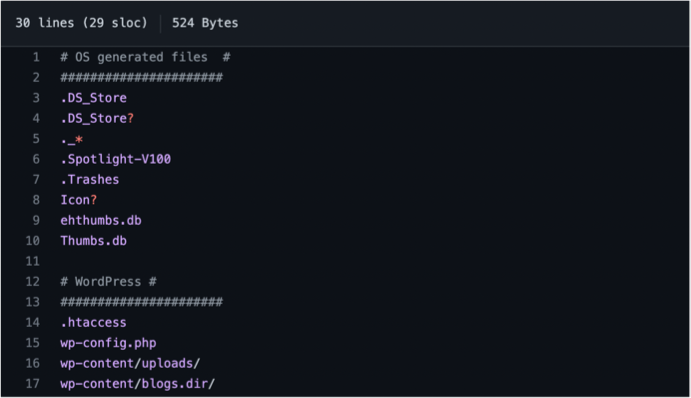

We stay up-to-date on everything that is evolving in the payments industry to make sure your payments can continue to support your business without incident. Here are just some of the details we stay ahead of and optimize our technology for to keep your business running smoothly:

- Payment Card Industry Data Security Standard or PCI DSS is a set of requirements designed to ensure that all companies that process, store and/or transmit credit and debit card information maintain a secure environment. BlueSnap complies with Level 1 PCI-DSS, the highest in the industry.

- General Data Protection Regulation (GDPR) is a regulation that increases the level of control EU and UK citizens and residents have over their personal data in the new digital age and presents a more unified environment for international business across Europe.

- PSD2 is a mandate that governs regulated payment service providers within the European Union, UK and the European Economic Area. It is designed to increase competition and participation in the European payments system for merchants and other stakeholders by making payments more secure and reducing fraud. PSD2 also clarifies the liability issues between the acquiring and issuing banks, with the issuing banks taking on the liability.

- Wayfair Ruling allows US states to tax remote sales even if the business has no in-state presence. Prior to this ruling, states could only tax sales by businesses that had a physically presence within the state.

Features

Payment Regulations

With changing payment regulations, it’s difficult to know what applies to you. We stay on top of industry regulations and compliance requirements, so you don’t have to.

PCI Standards

We’re compliant with PCI-DSS Level 1. Whenever cardholder payment data is transmitted, processed or managed through BlueSnap, we apply the proper data tokenization.

Tax Calculations

Avalara’s tax solution is built-in to ensure you are compliant with tax requirements, automatically calculating and charging taxes on individual purchases

Checkout Compliance

A secure payment experience is necessary for payments compliance. Get frictionless payment authentication across a range of solutions that keeps customer data safe.

No Need to Be Taxed by Taxes – BlueSnap & Avalara Have You Covered

We’ve built Avalara’s tax solution right into our Payment Orchestration Platform to ensure you are compliant with your business’s tax requirements. Avalara automatically calculates and charges tax on individual customer purchases. Avalara also provides the capability to submit and file taxes on your behalf.

Solve for Strong Customer Authentication with 3-D Secure

With 3DS, you receive an advanced authentication solution implemented to meet PSD2 regulations by verifying a cardholder’s identity in real-time with Strong Customer Authentication. This additional layer of security helps prevent unauthorized use of cards and protects eCommerce merchants and issuers from exposure to fraud.

Our API provides built-in support for 3DS and it’s even enabled in our 3rd-party integrations like Magento, Zuora, WooCommerce and more, so you can start taking safe payments immediately.

Speak with a Payments Expert

At BlueSnap, we know payments. We’d love to help you strategize about how your business can get the most out of payments.

Industry-Compliant Solutions

At BlueSnap, we are vigilant about staying compliant with all industry regulations to allow you to process transactions securely. We work with you to ensure you have all the information and support you need to be advised on any payment regulations your business needs to follow. We monitor and track all regulatory changes and consistently inform our customers about any major implications, as well as the next steps to take.

Taxes Are Complicated – BlueSnap & Avalara Make Them Easy

We know how complicated managing taxes for your business can be. In addition to charging taxes correctly, you’re responsible for reporting on sales revenue, transaction volume and the region where your sales occur, which can be daunting.

Regardless of how you accept payments with BlueSnap, we can help you with the taxes. We have built leading tax automation software Avalara right into the Payment Orchestration Platform. Whether you accept one-time, recurring or repeat transactions, or refunds, rest assured your transactions and taxes with BlueSnap and Avalara are accurate.

Avalara automates the process of calculating and charging tax for your customers. Each product gets a unique tax code that is used in conjunction with your shopper’s address and your business address to calculate the tax rate. This simplifies the complexity of calculating taxes in more than 100 countries worldwide, accounting for special circumstances like tax holidays and product exemptions.