Payments are the lifeblood of a business. When payments flow well, everything else follows. That means it’s essential to choose a system that integrates well with your business and meets all your payment needs. These systems are often known as payment gateways.

So, What Are Payment Gateways?

First, a note on terminology:

You may have heard this term bandied about or used in different contexts. The problem is, the term “payment gateways” is often applied to systems that go beyond typical gateway functionalities, so the terminology can get confusing.

Think of it as a square vs. rectangle situation: all squares are rectangles, but not all rectangles are squares.

In this case, the broader category (the rectangle) is actually “payment platforms” or “payment solutions.” Payment gateways are a subset of that category (the square); other types of platforms also exist, such as payment facilitators. However, in general usage, people tend to use payment gateways as a blanket term for all platforms, essentially using a square to describe a rectangle.

It’s not technically accurate, but since it’s the term most people are familiar with, we often use the term payment gateways as well. In this post, we break down the different payment gateway types, including what we call “traditional or limited payment gateways” (the square again). Just remember that the broad category we’re discussing is really payment platform types.

Check out this blog if you’re looking for a more in-depth breakdown.

No matter the term, here’s what it means:

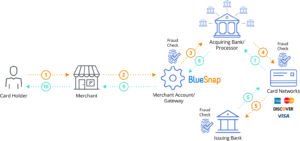

A payment gateway is essentially a bridge or connection pathway between your customers and the relevant financial institution. Gateways are a link between the merchant’s website and a payment provider or banking network. Essentially, they act as a “wire” that connects your site to a payment provider and allows secure payment data to flow back and forth.

Payment Gateway Types

The main payment gateway types can be broken down by how they’ve evolved over time, and thus what types of features they offer their users. Here are the three key types:

- Gen 1: Basic or Traditional Payment Gateways

- Gen 2: Startup-Friendly Payment Gateways

- Gen 3: Payments as a Service (also known as Full Payment Platforms, Payment Facilitators or Global Payment Gateways)

Gen 1: Basic Payment Gateways

Basic or traditional gateways provide the merchant with a single connection to a payment processor. This type is the most DIY — you’re essentially building your own payment solution.

A Gen 1 gateway is right for you if you want to sell in one country with just credit cards. If you’re looking for any other features, you’ll need to add those features with additional integrations (more on that later, but essentially it means more work for developers).

That means extra work for any other regions or payment types, whether it’s a bank or PayPal — and multiples aren’t a good thing. You’ll need to stitch together separate chunks of code for each feature you want — PayPal, credit cards, Google Pay — to manually create a cohesive payment system. Basic payment gateways can meet your needs, as long as you’re willing to front significant development and software resources to make it happen.

Basic gateways therefore require significant resources to maintain and are surprisingly expensive, not least because those resources cost time and money. It’s also hard to get around that extra work, since on average merchants use five gateway processors, four acquiring banks and six payment types.

Gen 2: Startup-Friendly Gateways

Gen 2 gateways are easier to use and come with more features, such as functionality that’s packaged for different regions.

Startup-friendly gateways are exactly what they sound like: they’re built for startups that are looking to grow but don’t need advanced payment capabilities. You’ll still need to invest significant amounts of time to building and customizing your solution if you want more than the fundamental payment services, but Gen 2 gateways do come with easy-to-integrate APIs.

Gen 3: Payments as a Service

The third way to set up payments is through payments as a service, also known as full payment platforms or payment facilitators.

Payment facilitators are an all-in-one package with robust payment features built in so you can easily enable the ones you need, rather than separate chunks of code. As such, they are much better for growing businesses, because their features can expand as your needs change. They also come with peripheral functionalities built in, like fraud or chargeback management.

Facilitators come with the most functionality of any payment gateway type. For instance, they have built-in support for multiple payment types and currencies, and so are fully capable of handling all your global payment needs.

Because facilitators are one cohesive system, they’re also far better for reporting. Instead of standalone integrations you then have to reconcile, facilitators have all your payment data in one place. Moreover, they’re far easier to manage for developers: facilitators require significantly less work than traditional gateways, with simple management for everything from setup to error codes.

A major reason for this advantage is that facilitators only need one integration. So what are integrations, and what are some common payment integration types?

Using Your Gateway: Payment Integration Types

Integrations are an important factor to consider when selecting your payment gateway. When you know which gateway type suits your needs, consider which integration options will help you make the best use of that gateway.

Integrations can be pretty specific, such as one integration just for Apple Pay, or a different integration so that your payment gateway provider can operate in different regions. If the integrations available from your provider don’t enable all the payments functionality you need, it’ll severely restrict your ability to expand globally or accept international customers.

However, more integrations isn’t necessarily a good thing. With more integrations comes more maintenance and support needs and a higher overhead — so look for a gateway that requires fewer integrations to give you the functionality you need.

There’s another wrinkle here: there are a few different ways to integrate your gateway. These payment integration types fall into three main categories:

- Hosted solutions. These are an out-of-the-box way to set up your payment gateway, such as hosted payment or checkout pages. They’re ideal for small teams with few developers; the payment provider handles things for you.

- APIs. APIs seamlessly incorporate the gateway with your website; they’re more suitable for organizations with developers who can handle the setup — especially because more APIs means more dev work. APIs are powerful, but the fewer the better.

- Software Development Kits (SDKs). An SDK functions the same way as an API, but it also comes with a set of tools, libraries, relevant documentation, code samples or guides that allow developers to accept payments in your app or website with a complete toolkit.

- Third-party plugins. If you’re already using an eCommerce platform, you’ll need a payments provider that already has a plugin for that platform; compare plugins from each provider to verify that they have all the features you need. With a simple integration, that plugin enables all the products and features of the payment provider.

The Right Combination of Gateway & Integration

So, to sum up: there are different types of payment gateways, which come with different features. Those gateways can be set up with different types of integrations, with different levels of development work required.

When choosing a gateway, first look for the features and functionality you need. Then consider the integration types you can use to set up that gateway. For instance, a Gen 2 payment gateway has some useful features, but you’ll need multiple integrations to connect to that gateway across different regions, so you’ll only benefit from those features if you can invest in the required development work.

Here’s a quick overview of the key takeaways:

- Basic gateways: limited features, most work to set up, multiple integrations

- Startup-friendly gateways: more features, can use APIs but still needs multiple integrations

- Payments as a service: most features and capabilities, easier setup, and one integration

Choose a provider that addresses all your needs. BlueSnap’s platform is a payment provider built for the future. We’re a Gen 3 payment facilitator — and our gateway is easy to integrate. With just one API, we provide access to all the features you could want: connects to a global network of 30 banks, popular eWallets, multiple currencies and locations, even local payment types. We also have a uniquely transparent system with clear uptime measures and inherent failover systems.

It’s an easy-to-use, all-in-one payment platform designed to increase your sales and reduce your costs. But don’t just take our word for it: check out our API to test it for yourself!