B2B adoption of digital payments has been rapidly growing over the past few years in reaction to the global pandemic. As the world has moved to remote working, businesses can no longer rely on paper-based physical payment methods to keep the cash flowing.

Digital solutions are speeding up the B2B payment process. Both online payments and accounts receivable automation are helping B2B companies of all sizes solve cash flow issues, boost productivity and increase customer satisfaction.

Let’s get a better understanding of B2B payments and what you should look for in a solution to support them:

The Benefits of Using a Digital B2B Payment Solution

How Do Digital B2B Payments Work?

Most Common B2B Payment Methods

Today’s Trends in B2B Payments

What to Look for In Your B2B Payment Solution

Best eCommerce Practices for B2B Sellers

How BlueSnap Compares to Other B2B Payment Solutions

The Benefits of Using a Digital B2B Payment Solution

First, consider the benefits of B2B digital payments, like:

Collect Payments Faster

If your B2B company still collects payments via a traditional, printed and mailed, 30-day invoice, then you may be compounding the issue of slow-paying customers. Our Progressing Payments report reveals that 43% of businesses admit that their too-lengthy payment cycle has a negative impact on their cash flow. If you’re experiencing the same issues, then you’re hurting your business’s growth, hindering your ability to forecast income and delaying any future business investments.

Both automating your accounts receivable and accepting digital payments reap a number of benefits, including helping you to get paid faster. With automation, you streamline processes, improve internal alignment, reduce errors and increase customer satisfaction. In fact, one BlueSnap customer reduced their Days Sales Outstanding over 85% by automating their accounts receivable. Collecting payments on time and faster is good for everyone involved.

Gain Operational Efficiencies

Online B2B payments reduce the work involved for your finance or accounting team. You could set up an online B2B billing system that automatically generates, sends digital invoices and includes an integrated payment solution like BlueSnap to handle receiving payments digitally. The time saved processing checks manually will free up your accounting team to do more high-level tasks.

Offer Convenience to Your Customers

Some of your customers may prefer to pay with a corporate card, either to earn rewards or because it helps them better manage their spending. When you accept digital payments and combine it with accounts receivable automation, customers can go to a portal or open an automated email, click one button to view the invoice and then pay it right then via a variety of payment methods. They can even set up automatic payment processing rules to make sure they’re paying on time.

Minimize the Impact of Unsuccessful Payments

If customers wait until the deadline is looming (or later) to send paper checks and the checks don’t clear, then you have to chase those customers down again and the process drags out even further. Although it’s possible for you to allow customers to pay an online bill with a paper check (all the same payment options can be available with an online B2B billing system as with your printed bills), most companies strive to get payments digitally.

That means encouraging card payments, electronic checks or ACH. Digital payments let you know whether or not the funds are available immediately. And if they aren’t, customers see an error message they can quickly resolve, shrinking the cycle even more.

How Do Digital B2B Payments Work?

Digital B2B card processing works the same way as a typical B2C card transaction:

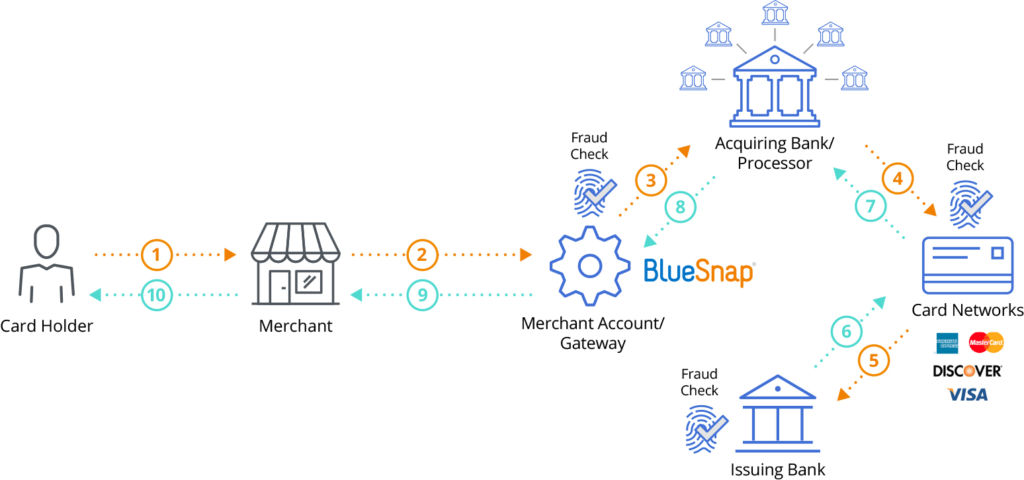

- The gateway captures the transaction request, encrypts the payment information and routes it to an acquiring bank.

- The acquiring bank (which provides your merchant account) takes ownership of the transaction request. Its job is to get authorization for the transaction.

- The issuing bank assesses the request: Does the customer have sufficient credit or funds? The issuing bank generates a response — yes or no — and sends it back to the acquiring bank via the card network.

- The acquiring bank sends the response back to the payment gateway.

- The payment gateway’s final job is to present the answer either back to the merchant or to the shopper directly (if you’re using a hosted payment page). Congratulations, your order is approved!

When compared to B2C payments, which are mostly paid right at point of sale, B2B payments can be more complex and take longer to process, as they can involve more people or teams to review and approve transactions, such as accounts payable, billing and the team that purchased the goods or services.

B2B payment processing also tends to entail larger quantities with higher (sometimes much higher) amounts of money transferred. Additionally, B2B payments are likely to be done on a more regular basis, meaning there’s a higher volume of recurring payments for the transfer of goods and services.

How Do Recurring Online Payments Work?

When you have an ongoing relationship with a customer, your payment system can include (though it doesn’t need to) a subscription element. Recurring or subscription-based payments should be as simple and straightforward as one-time payments. You’ll want to make sure your payment processor has the capability to automatically initiate subscription payments monthly, quarterly or annually — or at whatever interval you like.

And to make it easier for your customers, functionality like BlueSnap Virtual Terminal can be used to initiate a subscription or recurring payment plan for your customers so they pay the same amount on a monthly basis. If you send a digital invoice with a link to pay online, then the checkout page can be used to initiate recurring payments and allow users to save their payment information. Removing the need for customers to submit payment information more than once removes friction from the payment process.

Most Common B2B Payment Methods

B2B payment methods are generally the same as any other payment method. The difference usually comes in the volume and frequency of payments – so payment types that offer simplicity and efficacy tend to be the most popular.

- ACH: The Automated Clearing House (ACH)is a digital payment delivery service specifically for the US. ACH goes by several different names, like eCheck, ECP, automatic debit and electronic bill payment. At its core, ACH functions to move money from one account to another. It is an excellent alternative to card payments, particularly for B2B transactions.

- EFTs: Electronic funds transfers refers to any monetary transaction done digitally, such as through digital wallets, wire transfers and ACH payments. Outside the ACH system (which is processed in batches), EFT payments are instantaneous. EFTs can be completed through a lower cost compared to other payment methods, though some electronic payment services can include additional fees.

- Wire transfers: This is the act of moving money through bank accounts via a “wire,” made by either cash payments or digital distribution. This is a very secure means of payment but often requires more steps to process. In general, this is one of the preferred means of making international payments.

- Cards: Cards are a very reliable means of payment, and end-of-month statements offer convenient tracking for customers’ business records. There is the potential for higher fees with cards and spending limits can make it difficult for businesses to use cards as their primary means of payment – but the right payment partner can ensure that your corporate credits cards qualify for lower interchange fees.

- Checks: Though antiquated, paper checks remain common for some B2B payments. While checks do offer a clear paper trail, they are steadily losing popularity as they are more prone to delays and human errors. They can also take a while to clear.

Typically, most common credit/debit cards and EFT payments can be accepted for online B2B payments, and the preference for digital payments is likely to continue to rise. While B2B payments were steadily growing before the pandemic, the transformation of business payments from paper has greatly accelerated since 2020. The B2B payment market is expected to have a compound annual growth rate of 10.6% through 2028, reaching a projected market size of $1.9 trillion.

No matter your preferred method of accepting payments, when you have software that can effectively handle most (if not all) of the steps, you’ll benefit from greatly reducing processing time – that means faster payments. Make sure that your payment gateway has the right tools to make payments easy – especially when they’re online.

Today’s Trends in B2B Payments

The adoption of automation and new payment methods for B2B isn’t arbitrary. Technological innovations, customer preferences and rising challenges are pushing businesses to adapt or fall behind their competitors. Here are the three biggest trends we’re seeing that are driving B2B payments.

1. Digital Payments Are the New Normal for B2B

When the pandemic began, we weren’t expecting digital payments to become standard for another five to ten years. But faced with a global health crisis and lockdowns, contactless payments helped us get there in a year.

What began as businesses being unable to pay by physical check has turned into new habits. Even though the pandemic’s immediate effect is beginning to wane, businesses have adopted their new ways of doing business, getting paid and paying others – and it is all digital. Law offices, healthcare providers, childcare centers and more have changed their processes and policies to accept online payments.

Many of these industries previously sent paper invoices, only accepted cash or checks from clients, and overall had a payment process that generated a lot of paper. During the pandemic, touchless payments, whether with no-touch card payments or online payments — not only made doing business safer, but also simpler and faster for customers.

2. Automated Accounts Receivable Are Increasingly Popular

As businesses have implemented contactless payment solutions, accounts receivable (AR) automation has followed closely behind. It’s not only safer for employees and customers, but it’s faster and eliminates the potential for problems.

Automating your business’s AR processes makes payments truly touchless and reduces the likelihood of frustrating issues like double billing or losing track of a customer’s invoice. Regardless of industry, customers expect a seamless payment process that is automated and that they can handle on their own schedule. If you’re still forcing customers to talk to you on the phone to make a payment or mail in a check, they will inevitably get frustrated and look elsewhere for an easier, more automated process.

3. Rising Risk of Fraud and Other Financial Crime

While B2B fraud isn’t as high profile or prevalent as B2C fraud, it’s still an issue that you should consider as the rise in networking and remote access also raises the opportunities for fraud. Business email compromise (BEC) and business identity theft (BIT) can redirect payments to fraudulent accounts, and bogus credit card processing services can charge large fees or outright take the money.

Even when these cases of fraud are discovered and challenged, companies may have to fight the chargebacks from stolen cards. As a consequence, business may experience late payments, negative credit reports, harm to business reputation and personal liability. The right fraud prevention technology, whether internally implemented or from a trusted payment processor, can quickly intercept fraudulent charges before they’re completed, saving your company time and money.

What to Look for in Your B2B Payment Solution

Not all payment solutions are created equal, and some may introduce more issues than they solve. If you’re a B2B company using a payment processer to sell online, you might not be getting everything you really need. Here are some important features to look for:

- Easy-to-connect integrations and open APIs: All-in-One doesn’t mean one size fits all. Your business is unique and could be using any number of the hundreds of different business platforms and applications available to businesses worldwide. Don’t assume everything will automatically connect or take on the burden of trying to do it all yourself – partner with a payment solution that provides the support and technology to make integrations a snap.

- Support for different billing models, currencies and payment methods: You’ll want to be able to provide a seamless customer experience. Can customers pay through their preferred method? Is their information automatically saved and applied to different forms? Does your solution offer convenient features like service portals and subscriptions? Details like these make the payment process seamless, so your customers won’t be stopped/get hung up along the purchase process.

- The capability of managing subscription payments: Don’t overlook this important feature for providing more payment options for your customers, because your competitors aren’t. A good subscription service will offer you flexible pricing models to fit your needs – great services will support your business with features like automatic retries for charge failures and automatically updated customer payment information.

- Does it provide extensive reporting: Don’t let valuable insights go to waste. Every transaction and customer interaction contains crucial information on your business performance. You’ll need the ability to quickly identify what’s working and what’s not to protect your revenue.

- Whether it can address conversions and cross-border fees through local acquiring: A lack of advanced functionality or global capacity could be stalling your online sales. You’ll want your payment solution to be able to ensure that most payments get authorized – no matter where the customer or their bank is located – and be able to fully support local currencies and preferred payment methods for different countries.

- End-to-end AR automation: While digital payments are a big help, fully automating your accounts receivable automation can revolutionize your business by improving your cash flow, increasing customer satisfaction, boosting productivity, and improving forecasting and planning. Look for a payment solution that can help you manage your payments and get paid faster with holistic, global solutions.

- If it requires multiple payment gateways or merchant accounts: You don’t want to overly complicate the B2B payment process or suffer unnecessary tech debt. You shouldn’t need more than one payment gateway to provide everything you need for successful processing – if you’re using multiple gateways to handle your payments, you’re putting yourself at a disadvantage. If you are using multiple payment solutions, look for a single platform with everything you need built-in for platform consolidation.

If the business software you’re already using can’t provide the services you need, then it’s time to reevaluate how you’re implementing B2B payments. Consider these top eCommerce payment practices for B2B and how the right payment provider can help.

Best eCommerce Practices for B2B Sellers

1. Offer a Range of Payment Options

Large companies often prefer invoices, and they may even refuse to buy from an eCommerce site that doesn’t offer them. You can make invoices even easier to pay by adding a payment link, which immediately takes customers to a secure webpage where they can quickly pay what they owe.

You should also be encouraging efficient, repeat sales by offering subscriptions or recurring purchases. Rather than requiring shoppers to return to your site time and time again, filling out the same information, give them a way to set up orders automatically.

In addition, electronic invoicing and payment collection makes accepting different payment types easy.Having automated AR with embedded payment links and the right payment processor allows your customers to use the payment types they prefer without creating more work for your employees.

2. Offer Local Payments for Global Customers

Another way to enhance your B2B eCommerce site is to offer payment options that match customers’ regional and cultural preferences wherever they are in the world. Cross-border payments require special attention. For one thing, international payments processed by banks outside the region in which they originate (for example, a European bank trying to process a US credit card) are up to 30% more likely to be declined.

That means you need the ability to accept payments in numerous currencies around the world, in a wide range of payment types and the ability to process the payments locally wherever you have a legal entity. Creating a payment experience that feels local for customers, no matter where they live, is not only good for them but also good for you, since they’re more likely to complete the transaction if they see a familiar payment type.

And local card acquiring will improve your authorization rates and help you avoid unnecessary cross-border fees. Many so-called “global” payment providers offer limited services in these areas – you need a complete menu of options to successfully sell in all corners of the world.

3. Ensure Your Processing Is Secure and Compliant

Digital payment fraud won’t ever go away, but you can reduce the impact it has on your business by employing a more sophisticated fraud-fighting strategy— one that minimizes both criminal attacks and unnecessary declines. Additionally, chargeback management, while not always related to fraud, is important for recovering revenue and sustainable business growth.

Because your payment gateway will be handling credit/debit card transactions, make sure it’s compliant with the Payment Card Industry Data Security Standard (PCI-DSS). PCI compliance can be costly and burdensome — unless your payment processor handles much of the burden for you. Find out what type of PCI compliance level they would provide.

4. Analyze to Optimize All You Do

Payment analytics can help you minimize your costs and maximize your strategies to improve your business’s overall performance. Payment analytics can provide insight into how your products are performing in different regions, and how different payment types and currencies are contributing to your revenue. Having those insights at your fingertips will allow you to hone your sales strategy.

5. Benefit from Easy Integration with Your Other Business Software

The right payment solution should alleviate your development team’s workload, not add to it. Be sure the payment technology you choose works with the platforms and tools you already use.

Integrations with your existing software should be an important qualification for whatever payment gateway you choose. It gives you more ways to accept payments from customers and increases efficiency. This will help to eliminate technical debt and increase your time to market with updates and enhancements to improve your own customer experience and increase sales.

How BlueSnap Compares to Other B2B Payment Solutions

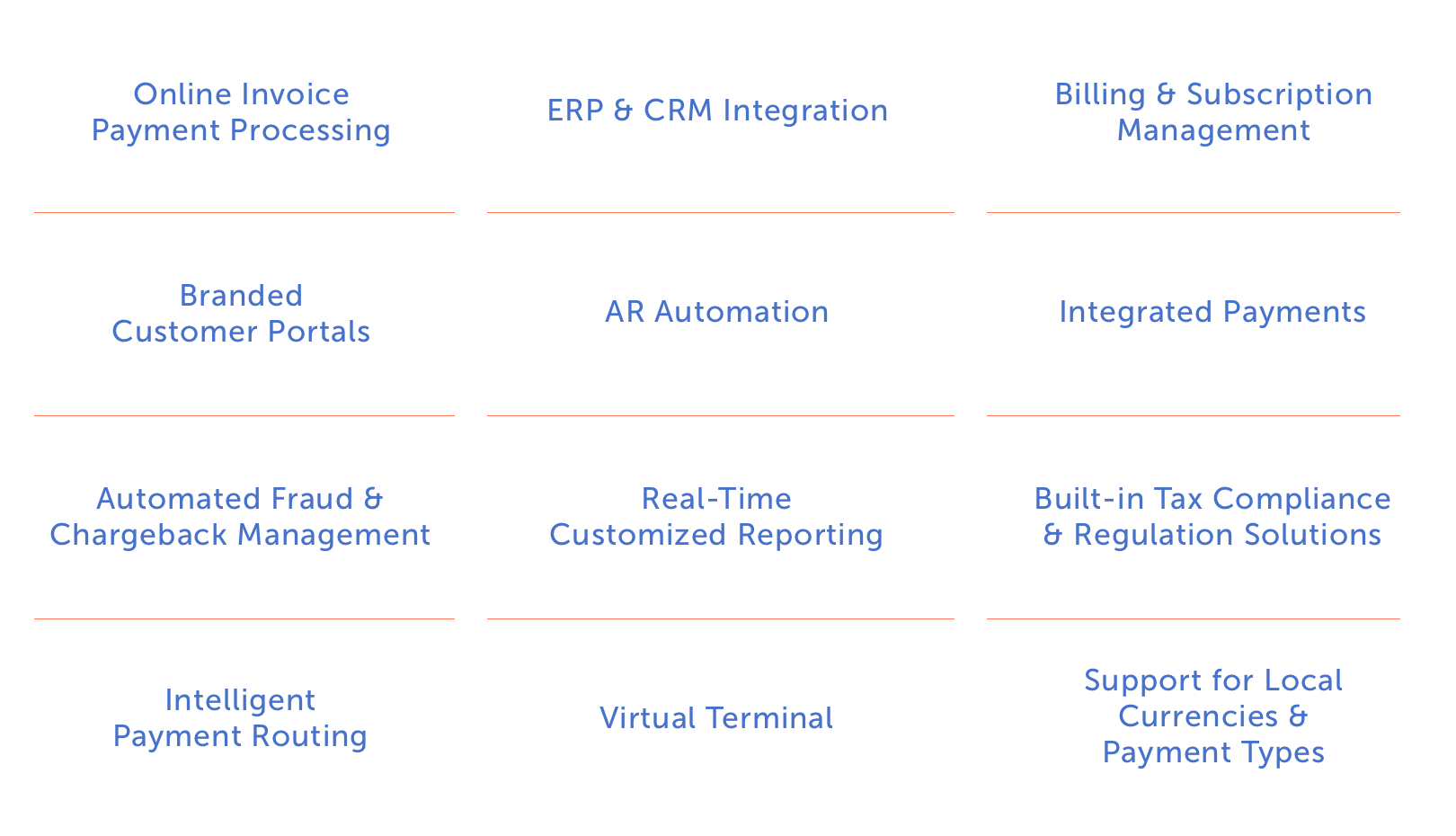

When we say all-in-one, we mean it. One contract and one account provide your business with access to all the features and functions a modern B2B company needs – and it’s all modular, so you can turn on only the functionalities that you want. Here is a sample of our B2B payment offering:

Interested in seeing what a switch to BlueSnap for your B2B digital payment processing could do for you? Then it could be time to talk to one of our payment experts. Here are some of the topics they’ll discuss with you:

Review Your Current Payment Infrastructure, Process and Results

Examine your current state of payments, including:

- How many days it takes you to receive customer payments

- Your process for invoicing and accepting payments

- The different payment methods you accept

- The amount of effort it takes to complete a payment

Document it all to get a clear view of the costs associated with your payment process and where it might be failing. From there, you can ask more specific questions about your process, including:

- Can your customers easily use a link from invoices to quickly pay online?

- Do you have a web-based payment application like a virtual terminal to process phone, fax and email payments?

- Is your AR automated to provide your business with automatic customer automatic billing, applied late fees, email tracking and insights to help you get paid faster?

Assess Your Global Payment Needs

Know where your customers are coming from so you can tailor your payment infrastructure to those regions. If you’re a US business, for example, what percent of sales are made in Asia, Africa, the EU, UK or other regions? Some B2B companies that have made the switch to BlueSnap have seen a 25% uplift in conversion rates simply by having a payment partner with the right mechanisms in place (like Intelligent Payment Routing) to support transaction approvals.

Identify the Full Cost of Using Multiple Gateway Providers

Whether you have four gateways or 10, working with multiple providers is more costly than working with one. Investing more manpower into keeping all those integrations up to date means you’re missing out on some significant economies of scale. To make multiple gateways work smoothly, you’ll need to code and support them individually, which becomes a nightmare with regular updates and adding payment methods or other functionality.

You’re increasing your overall tech debt, which means greater opportunity cost in team bandwidth and greater maintenance costs for each payment technology. Bottomline: having a single payment provider like BlueSnap that has all the functionality you need built-in is just good financial sense.

Document Your Fraud Trends and Gaps

An unfortunate B2B eCommerce trend is the rise of fraud. Every business that conducts online transactions more than likely has some level of fraud protection in place to help lower the risk, but it’s not always easy to know how well it’s working.

The first step in evaluating your fraud controls is to document trends. Note the levels of fraud you’re seeing in different parts of the world and compare them. Also note the regions in which you don’t have fraud protection.

Once you’ve identified all the difficulties and the gaps, you’ll be better able to evaluate your current provider’s fraud solution against that provided by BlueSnap. You’ll also have a basis for experimentation when it comes to adjusting fraud rules.

Compare the Features of Your Current Gateway(s) vs. BlueSnap

You may think that by switching from many payment providers to one you’ll miss out on certain features, but that’s not the case with BlueSnap. Compare your current gateways to BlueSnap’s All-in-One Payment Orchestration Platform, and you’ll see we not only have extensive global coverage but a host of other features that help B2B companies get paid faster.

Plus, BlueSnap integrates with hundreds of partners, including business software solutions (like Salesforce, LimeLight, Netsuite and more) and numerous shopping carts (like Magento, WooCommerce, BigCommerce and WordPress, just to name a few).

If you’re ready to get started, talk to a BlueSnap payment expert who can answer your questions or help you get started. As your B2B payment partner, BlueSnap’s committed to giving you everything you need to create an exceptional experience for your customers — and to find efficiencies for your business, too!

Related Resources:

- 5 B2B Invoicing Missteps and How Invoice Automation Can Help

- The Business Case for AR Automation [Infographic]

- Quiz: How Do Your Accounts Receivable Processes Compete?

Frequently Asked Questions

How are B2B cross-border payments different from B2C?

As international commerce grows, B2B cross-border payments are increasingly important as B2C payments, but functionally they often lag behind B2C payments in terms of customer experience, transaction speed, amount of manual effort required and more. B2B companies can close that gap, and see a 25% uptick in conversion rates, by choosing a payment processor optimized for cross-border transactions.

What are recurring payments?

Recurring billing and subscription billing are essentially interchangeable terms for a payment model where a business automatically charges a customer’s credit card for products or services on a regular billing schedule.

Recurring payments occur when customers enter their billing information once and grant the merchant permission to charge them at an agreed-upon cost and frequency. Subscription services will charge recurring payments on a monthly or annual schedule, until the customer withdraws permission or cancels their subscription.

What are the advantages of AR automation?

- Fewer manual tasks mean less busy work for your teams, allowing them to focus on higher value operations.

- Automatic account updating means immediate updates and instant notifications, reducing costly downtime and ensuring that payments are faster.

- Dashboards are updated in real time, providing instant insights into important metrics such as AR performance, customer accounts, payment processing and more, for better overall data management.

- Faster turnaround times and fewer errors result in less frustration for customers, while branded portals offer secure places for them to pay online.

- Overall improved efficiency saves your company money, makes it easier to scale and can lead to more business opportunities.

What is BlueSnap?

BlueSnap helps businesses accept global payments a better way. Our All-in-One Payment Orchestration Platform is designed to increase sales and reduce costs for all businesses accepting payments.

BlueSnap supports payments across all geographies through multiple sales channels such as online and mobile sales, marketplaces, subscriptions, invoice payments and manual orders through a virtual terminal.

And for businesses looking for embedded payments, we offer white-labeled payments for platforms with automated underwriting and onboarding that supports marketplaces and split payments.

With one integration and contract, businesses can sell in over 200 geographies with access to local acquiring in 45+ countries, 110+ currencies and 100+ global payment types, including popular eWallets, automated accounts receivable, world-class fraud protection and chargeback management, built-in solutions for regulation and tax compliance, and unified global reporting to help businesses grow.