We are very excited to announce the latest enhancement to Payment Analytics in the Powered Buy Platform – Payment Conversion Reporting. These are self-service reports, available in your merchant portal, designed to help you better manage your payment conversions.

Many of the merchants we talk to don’t have a good process for managing their payment conversions. And to be fair, it’s hard to manage what you can’t measure. Now there is no excuse. Our Payment Conversion Reporting provides the data you need to continuously improve your conversions.

Examples of Payment Conversion Reporting:

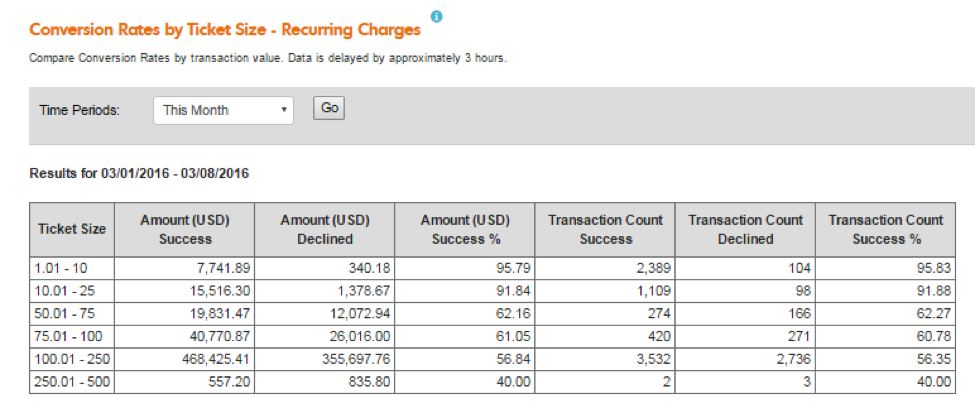

Payment Conversion Reports allow you to track conversion rates over time (either month-to-month or day-to-day), by ticket size, and by card type. The screenshot below is a sample report based on ticket size:

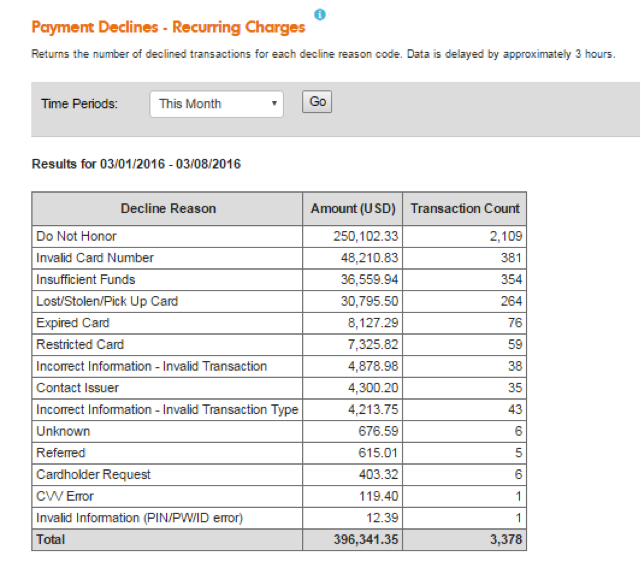

You can also see a breakdown of your declined transactions by reason code such as insufficient funds, expired card, and invalid card number (sample report below). And because conversion trends can be very different for first-time and recurring charges, all of our reports allow you separate these different transaction types:

So much energy goes into getting a shopper to click buy. Don’t let it go to waste by losing sales due to payment declines. Minimizing payment declines and checkout abandonment is an on-going process of reviewing success rates and changing your checkout pages. Payment types, currencies, and product pricing are some of the major factors that influence your conversion rates. Our Payment Conversion Reports allow you to quantify the impact of the changes you make.

Payment Conversion Reports will be available in Beta later this month, and we’ll be communicating with customers as we prepare to expand availability.

Have more questions on Payment Conversion Reports or how you can increase conversions on your eCommerce site? Reach out to one of our Conversion Consultants today by clicking the button below: