When it comes to choosing the best payment gateway, it’s easy to get bogged down by the surplus of information available on the web. That’s why we’ve put together this guide, which will give you step by step instructions on how to choose the best payment gateway for your business and give you answers to the most commonly asked questions.

How to Choose the Best Payment Gateway

-

Choose An Integration Option

When it comes to choosing an integration, there are three options: API, Hosted Checkout, and the Hybrid approach. Let’s take a look at the benefits of these three options.

- API: An API integration will work best for you if you want full control over the user experience and you have a team of developers who are able to build your checkout pages and monitor their success. For this integration, you’ll simply plug a payment gateway into your existing web page to operate behind the scenes. With an API integration, you’ll be responsible for more of the PCI burden as you will be collecting and storing shopper data.

- Hosted Checkout: If you’re a merchant who does not have the capacity or desire to code your own checkout pages, a hosted solution will be the most efficient. This option is often preferred by startups or small businesses who do not have a full in-house development team.

- A hybrid approach: A hybrid approach is a great option if you want to integrate through the API, but are not willing to take on a large portion of the PCI compliance burden. At BlueSnap we offer merchants interested in a hybrid approach, hosted payment fields which are small transparent iFrames that replace sensitive credit card data in your checkout form.

Remember, whatever option you choose can be changed. If a hosted checkout solution best fits your needs at the onset but later down the line you decide your site needs a total redesign, you can always switch to an API integration or a hybrid solution – the best payment gateway for your company should allow you to choose from any or all of these options and change at any time.

-

Decide How You Want To Architect Your Purchase Flow

Will your checkout flow be long and arduous with multiple form fields and steps? Or will you send customers through the flow with ease by offering one-click purchase options for return shoppers and emailing coupon codes before customers checkout?

Of course, the goal is always to have a simple flow that will minimize friction and offer the best experience for your shopper. The responsibility of the best payment gateway is to advise you on best practices for purchase flow and to make sure you are collecting only the most vital information — so your shoppers not only convert into buyers but return to your site time and time again.

-

Figure Out What You Want To Learn From Your Sales Data

When it comes to sales, knowledge is power. The more data you have, the better. Tracking data such as subscriptions, total transactions, revenue, conversion rates, payment declines, shopper locale, currency, payment method, and more will help you analyze your eCommerce business with a critical eye for continued growth.

The best payment gateway should offer thorough and easily accessible reporting. We’ve written a lot about checkout conversion management, and how in-depth reconciliation reports and analytics are a key element of a successful management process.

-

Decide If You Want To Offer A Localized Shopper Experience

Ecommerce no longer operates in an insular US market. And in a global economy, offering a localized checkout experience is one of the most integral aspects of creating a successful eCommerce business.

In fact, today cross-border is worth $300 billion and is expected to triple in the next two years. Target, for instance, recently announced that it would be creating a whole new website specifically for its cross-border eCommerce customers, with localization as a top priority. This move came as a result of their realization that they were missing out on millions of dollars by neglecting a large portion of their potential customer base.

Be sure to stay on top of these trends, not trailing behind them (and the best payment gateway for your eCommerce business should be keeping up, too).

-

Understand Your Customers. Will Setting Up Recurring Business Models Be Beneficial?

This step is especially important for SaaS companies, but that doesn’t mean other eCommerce businesses are exempt. A recent study we conducted with PYMNTS.com revealed that transaction values above $250 only have a 67% conversion rate. The solution for increased conversions is not to lower the price tag of your product, but rather to offer multiple subscription billing options so that transactions are not flagged for fraud and shoppers can purchase at a price they can afford and at a frequency they are comfortable with.

You’ll want to consider the robustness of a potential payment gateway’s recurring billing options. Do they have monthly, quarterly, and annual options? Do they support free trial offers?

In addition to increasing conversion and keeping customers happy, subscription billing is beneficial to you as the merchant. Reporting revenue on a monthly and/or quarterly basis is a great way to keep investors happy and increase the legitimacy of your company.

-

Understand What It Means to be Mobile Optimized

If a payment provider doesn’t offer solutions that are optimized for mobile, they likely aren’t keeping up with eCommerce trends and won’t be able to provide you with the support you deserve. Mobile optimized means much more than a sleek website design. The best payment gateways have one-click buy options for return shoppers and are integrated to multiple mobile wallets. The future is calling, make sure you choose a payment gateway that won’t let it go to voicemail.

-

Do Your Homework on Cyber Crime and Fraud Solutions

Cyber crime is one of the greatest threats to businesses today. That’s why it is critical to partner with a payment gateway that goes above and beyond when it comes to security. The best payment gateways offer robust fraud protection to keep your site legitimate, and to keep your customers’ information safe. For example, at BlueSnap we partner with Kount, a leader in fraud and risk management, to ensure our customer’s sensitive data is kept private and secure.

Conversely, you want to make sure that your fraud rules are not too aggressive and getting in the way of your customer experience. Let’s look at a use case.

Say you are a merchant in the gaming industry. Your game requires customers to buy tokens at a rapid rate to advance within the game. Most anti-fraud rules would immediately flag this rapid transaction rate as fraud, shutting down the play of the game and frustrating your customer. With a more robust fraud provider (such as BlueSnap’s partner, Kount) you can configure fraud rules that match your business model to keep your business protected and your customers happy.

-

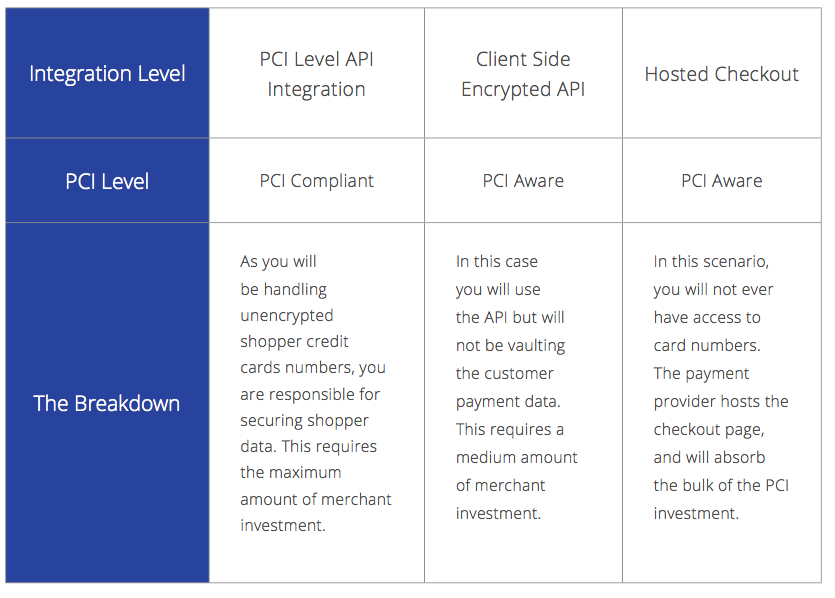

Become Familiar with PCI Compliance

When it comes time to think about PCI compliance you may find yourself reaching for more Advil. But PCI compliance doesn’t need to be a headache. Talk to your payment gateway about the different options and use this helpful chart to determine what level of PCI compliance your integration will require. For further information on PCI compliance visit the security standards council website.

-

Determine What You Want Your Payout Schedule to Be

Cash flow is a phrase near and dear to every merchant’s heart. And determining the frequency of this cash flow is crucial to running a smooth business operation. If you’re a well-established merchant, the best payment gateway for your company should be able to offer flexibility when it comes to payouts. If you’re a startup or small business still working on building a track record of sales and a credit base, you will likely be locked into a more rigid payout schedule at the onset. Talk with your payment gateway to determine what level of flexibility you will be given and to see how willing they are to work within your requirements.

-

Decide if You Want to Go With a Full Stack Provider

A full stack platform will provide you with both a payment gateway and a merchant account — both of which you will need in order to process payments online.

The payment gateway is used for facilitating online transactions and helping them get approved. It is also the first place the transaction goes when a customer submits an order online. The transaction flows through the payment gateway, to the payments ecosystem, and should it be approved, will eventually make its way into the merchant account. The merchant account is for reconciling the funds. These are the funds that were approved through the payments ecosystem. All approved payments are paid out to you, the merchant, through your merchant account.

A full stack platform is often much more convenient, offers a more streamlined experience and can end up being cheaper than using different providers for your merchant account and your payment gateway.

Once you understand what you need from a payment gateway you are ready to start comparing your options. Here are some crucial questions to ask providers as you search for the best payment gateway.

-

How much do you charge?

For US merchants the standard pricing schedule is 2.9% +$.30 per transaction. Most providers have a tiered, shared revenue pricing structure, which means the gateway’s success is directly tied to yours. This model ensures that your payment provider will be invested in the success of your business. Though per transaction prices are fairly standard across the industry, be sure to look for a gateway with a transparent price plan. For instance, if they advertise a lower per transaction price but slap on eight hidden fees, you will ultimately lose money. Some hidden fees to look out for include: interchange fees, qualified vs. non-qualified fees, gateway fees, software fees, subscription engine fees, fraud protection fees, and general maintenance fees.

-

Does my merchant bank account need to be in US dollars?

Your merchant bank account should not need to be in US dollars. The economy is global and your business should be as well. Choose a provider who can handle and payout money in foreign currencies.

-

Speaking of US Dollars, what’s the deal with foreign exchange fees?

Because foreign exchange fees can hike up your costs you should look for a payment gateway that can settle in multiple currencies without incurring any additional fees.

-

How will you help me increase conversions?

Did you know that only 10 percent of merchants are currently tracking their conversion rates? This means that most merchants are missing out on a HUGE opportunity to understand how well they are performing and how they could improve. In fact, merchants without site analytics lose up to 40 percent of sales annually. Offering in-depth analytics and reporting is just one of the many ways that the best payment gateway providers will be able to help you boost conversions.

-

How long will it take to get my integration up and running?

The most important thing to consider here is giving you enough time to thoroughly test the purchase funnel. This will be one of the most important factors when determining how long it will take to get your new gateway up and running. Furthermore, time to launch will depend on the assets you currently have, and what you are looking to have by launch. If your developers already have a site they are happy with and simply want to integrate a new payment gateway into the API, then you could be up and running in less than 24 hours. If you’re looking to rebuild your site or build your checkout page from hosted pages, the process could take a bit longer. But the best payment gateway should be able to work within your time constraints and get you up and running fast.

-

What do you offer in terms of localization and what does your local checkout experience look like?

To create a thriving business you need to offer a global experience. When a shopper lands on your page, you’ll want to be presenting information in the local language and displaying prices in local currency. When it comes time to checkout, you’ll want to offer local payment methods and make sure to be utilizing intelligent payment routing —connecting to multiple acquiring banks. Don’t just take our word for it, watch first hand the frustrations that can occur and the sales you’ll lose when you don’t connect to multiple banks. Did you know that abandonment rates are as high as 67% for merchants who don’t offer a localized experience? So be sure to ask any potential payment gateways what they offer in terms of localization and how they help their merchants sell in international markets.

At BlueSnap we pride ourselves on being a forward-thinking, leading payment gateway solution for eCommerce merchants of all sizes and across all industries. We believe every customer has the right to a seamless online experience and the ability to purchase easily, quickly, and securely. And because merchants like you spend countless hours bringing their products to market, they deserve the technology, tools, and support to create an exceptional buying experience.

Contact a BlueSnap conversion consultant today to learn more about our global payment gateway.