If you’ve been following along with the payments industry news for the past year or so you’ve no doubt heard the concept of “Frictionless Checkout”. We’ve talked previously about some of the factors that go into creating a frictionless checkout experience. For example, what payment options do you offer? Do you support the currencies local to your shopper? What data do you require from your shoppers in order to complete the checkout? Do you support guest checkout and also allow shoppers to create an account for faster checkout in the future? Identifying and properly implementing these factors is crucial, but it is only part 1 of the equation.

Part 2 of the equation involves managing fraud while keeping checkout frictionless. The challenge to this equation is finding the right balance for your company. Do you have a quality fraud engine monitoring your transactions? Are you asking the right questions of your shoppers to properly identify fraudulent activity? Are you monitoring order velocity for specific credit cards, email addresses, and device? A perfectly designed checkout page that requires too few data elements could expose you to higher fraud, however too many data elements could be a turnoff for your shoppers and cause them to abandon the checkout process before completing the sale.

Helping merchants balance this equation was one of the reasons we built our Payment API. We know that the checkout experience is not a one size fits all and each merchant has their specific requirements to build their perfect checkout experience.

While all merchants must have an excellent fraud engine monitoring their transactions, a US merchant selling only digital goods can likely offer a checkout flow with just a few fields, and offer only USD as the currency. However, a physical goods merchant selling around the globe will require more data elements to capture billing and shipping addresses, and will also need to offer more currencies to localize the checkout experience for their shoppers. The good news is our Payment API provides both of our hypothetical merchants with a way to design their checkout flow with the protection of a world class fraud engine.

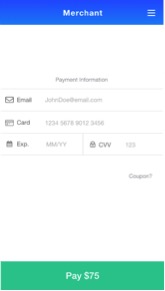

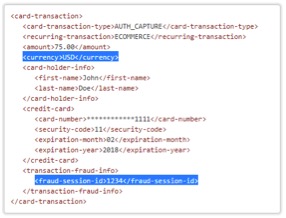

Example 1: Minimal checkout fields for frictionless checkout, with fraud session ID (device ID)

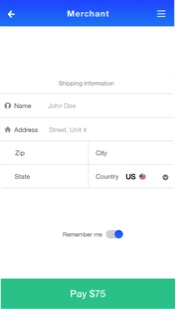

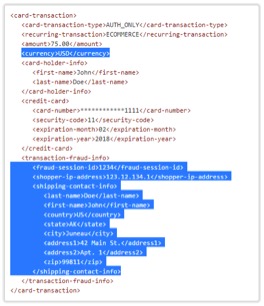

Example 2: Collecting shipping details

These are just two examples of the ways you can use our BlueSnap Payment API to build a checkout experience that is perfect for both your shoppers and your business model while maximizing payment conversions in the process. Want to learn more about frictionless checkout? Check out our documentation or talk to one of our conversion consultants: