Protect Your Revenue with Fraud Prevention

Built-In Fraud Prevention Tools That Preserve Your Business

When it comes to digital payments, it is hard to find the right balance between risking fraud and restricting sales. BlueSnap’s Global Payment Orchestration Platform, with Kount’s award-winning fraud prevention solution built-in, makes it possible to verify legitimate customer transactions while declining suspicious transactions. This optimizes your revenue while safeguarding your company.

42%

of businesses say digital fraud slows innovation and growth. BlueSnap with Kount’s fraud prevention not only fights fraud and preserves revenue – it also helps you manage your business.

Prevent Fraud from Compromising Your Business

Protect Revenue

Customize Your Prevention Strategy

Easily Manage Risk

Take Action

Prevent Fraudulent Chargebacks

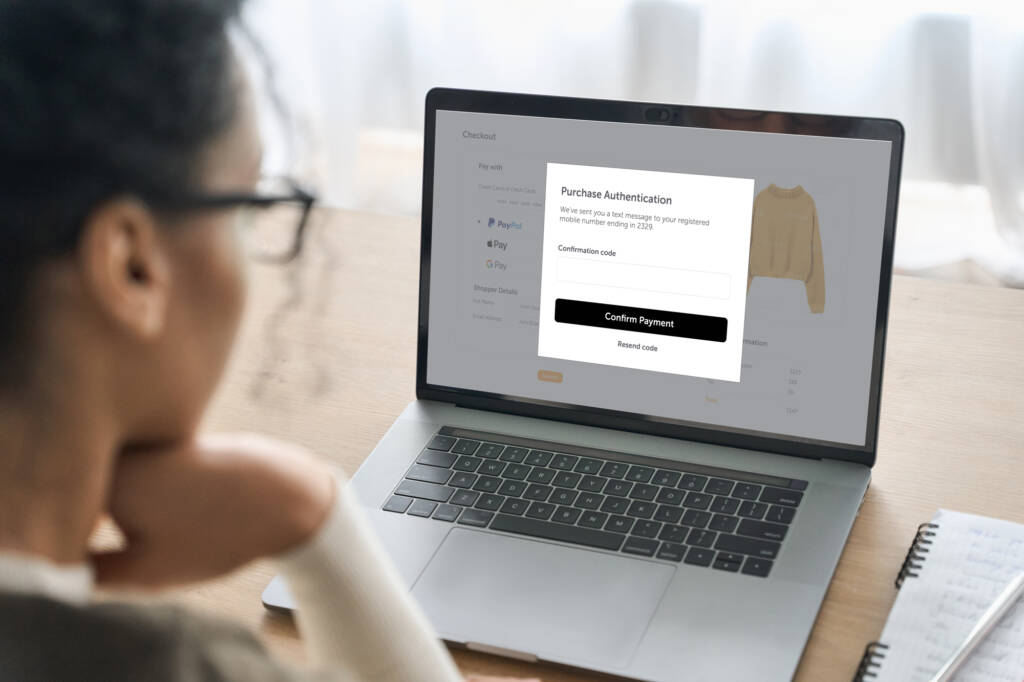

Failing to stop fraudulent transactions can also lead to higher chargebacks and chargeback-related expenses, in addition to lost revenue. That’s why it’s important to keep your business safe. By complying with industry regulations and implementing features such as 3-D Secure’s Strong Customer Authentication, you protect your business by shifting the liability of fraudulent chargebacks to the card issuing bank.

Features

Device Fingerprinting

Associate device anomalies with fraud patterns to better optimize your fraud detection.

Identify Transaction Origin

Accurately identify legitimate customer transactions to improve their payments experience.

Domestic & Foreign Transaction Monitoring

Safely accept transactions from domestic and global customers to maximize business growth.

3-D Secure

3DS2 provides Strong Customer Authentication to reduce your exposure to fraud.

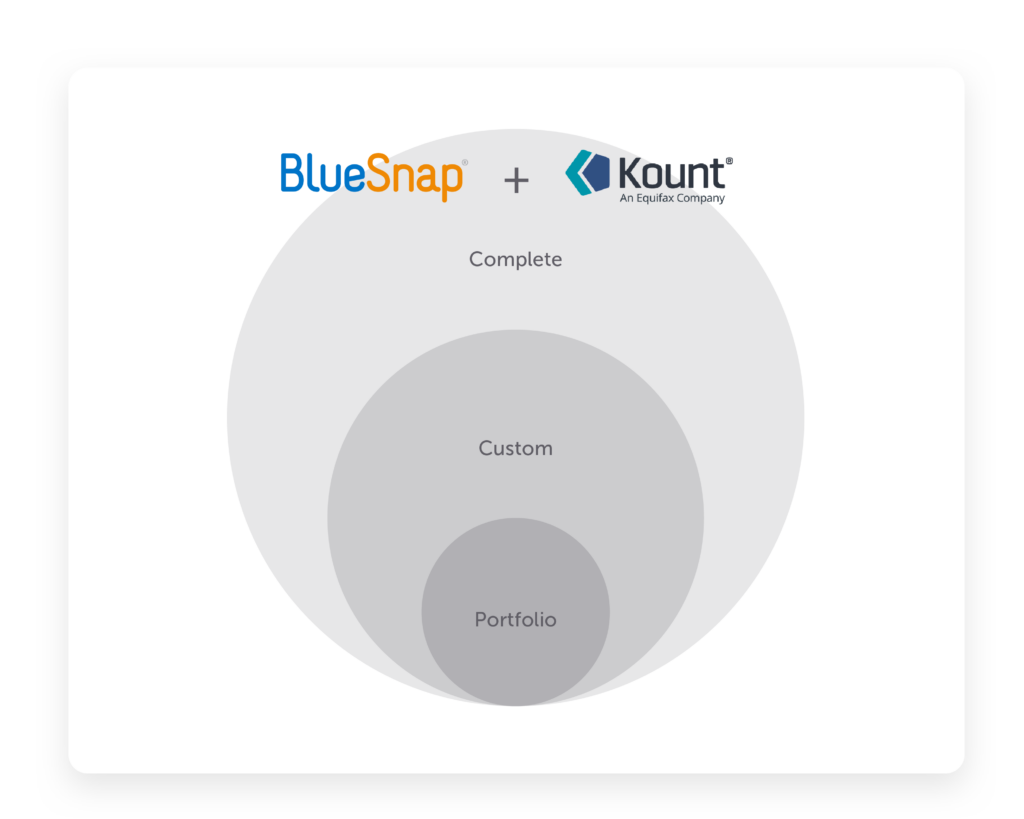

Choose the Right Fraud Prevention to Fit Your Business’s Needs

Portfolio Fraud Prevention

Enabled by default, the Portfolio level uses the most sophisticated fraud detection technology available to analyze every transaction for fraud indicators and takes action based on the results.

Custom Fraud Prevention

Ideal for businesses that want to customize varying key fraud variables to tailor their fraud prevention strategy to match their business needs.

Complete Fraud Prevention

Ideal for businesses that want full control over their fraud prevention strategy from fully automated order acceptance processes to creating and maintaining fraud rules, and more.

The Network Effect Built-In with Kount

There’s a reason Kount, an Equifax company, is trusted by over 9,000 companies globally. Kount’s machine-learning technology leverages data from thousands of global businesses, stopping fraud in real-time without introducing customer-facing friction. You benefit from their entire network. The best part? This award-winning technology is integrated with our platform, which means you’ll have powerful payment fraud prevention built into your payments solution with no additional development or IT resources necessary.

Speak with a Payments Expert

At BlueSnap, we know payments. We’d love to help you strategize about how your business can get the most out of payments.

Maximize Conversions & Reduce Fraud with 3-D Secure

With 3DS, you receive an advanced authentication solution implemented to reduce eCommerce fraud by verifying a cardholder’s identity in real-time with Strong Customer Authentication. This additional layer of security helps prevent unauthorized use of cards and protects eCommerce merchants and issuers from exposure to fraud.

Our API provides built-in support for 3DS and it’s even enabled in our 3rd-party integrations like Magento, Zuora, WooCommerce and more, so you can start taking safe payments immediately.