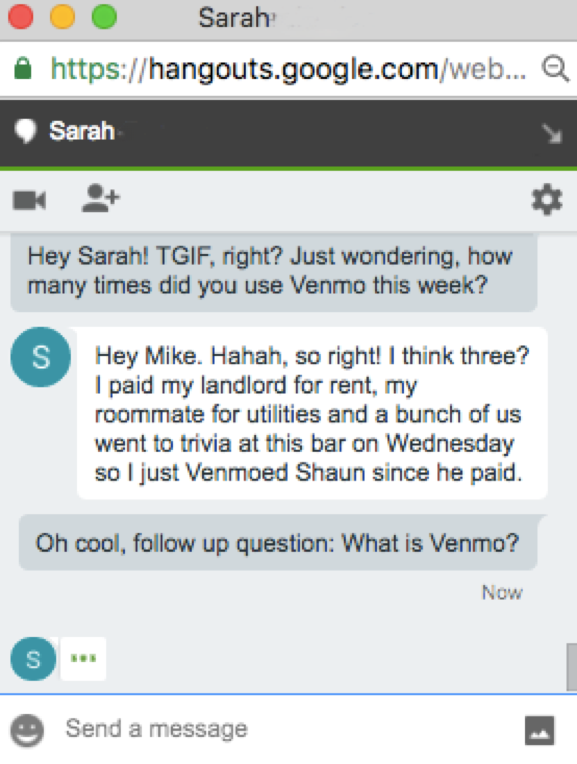

Do you see that millennial on her phone across the office from you? Go over and ask her how many times she used Venmo this week. Or send her a Skype/Slack/Gchat message. A sample conversation could look something like this:

At this point, Sarah might not know how to respond, so let us take a stab at it. Venmo is an app that enables you to share money by connecting to your debit card or bank account. It’s a wallet created by PayPal that has taken off amongst millennials like Sarah and her friends. For now, Venmo is purely for peer to peer money transfers, but we expect to see businesses adopting this mobile wallet in the next few months. There are other mobile wallets that have taken eCommerce by storm and if you want to capture more shoppers, it’s time for you to hop on the wallet train.

So why are mobile wallets options so important? For starters, mobile wallets are incredibly convenient. You don’t need to memorize your card number and type fifteen numbers in with fat fingers every time you need to make a purchase. You’ll input this information one time creating a username and password, and you’ll only have to remember your username and password for future purchases. But mobile wallets are more than a convenient way to pay, they are quickly becoming an integral part of the evolving world of payments.

Failing to adopt wallets could mean missing out on huge market opportunities. eMarketer projected a 210% growth in the total value of mobile payment transactions in 2016. This will bring 2015’s $8.71 billion to an impressive $27.05 billion. Mobile wallets also continue to close the gap between eCom and retail. Shoppers can pay with a mobile wallet like Visa Checkout, MasterPass, or Apple Pay in store, in-app, and on eCommerce websites. First Annapolis reported that while in May 2015, only 40% of a respondents from a study had made a mobile payment in the last year. By June 2016, that number rose to 74% of respondents. It’s clear that the adoption rates and generally awareness for mobile wallets are on the rise for consumers. Now it is up to businesses to integrate these alternative payment forms in their checkout processes to offer consumers the most streamlined checkout experiences available.

So which is the best mobile wallet? The jury’s still out on that one, but here is a helpful chart on some of the most popular wallets and how they work.