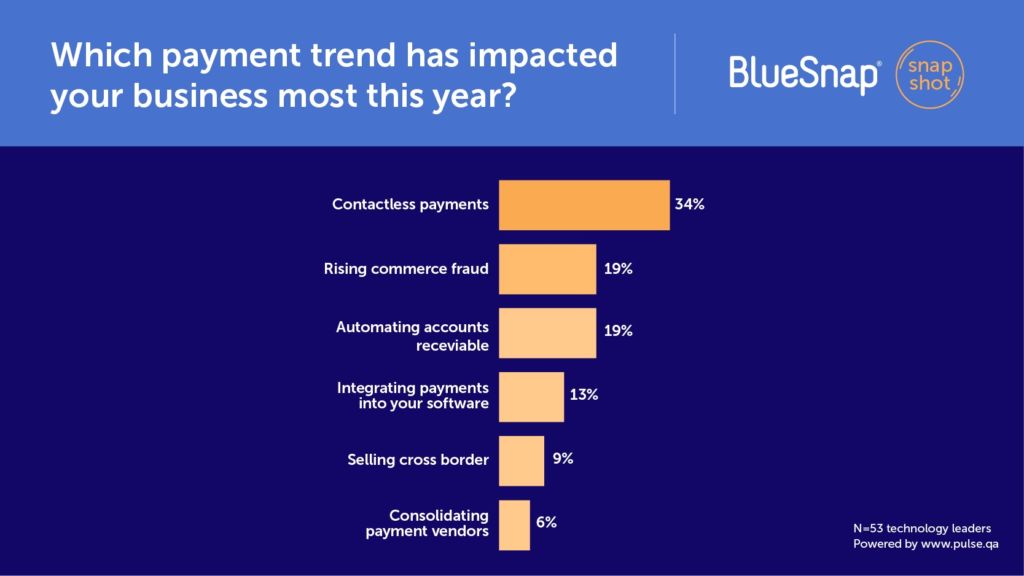

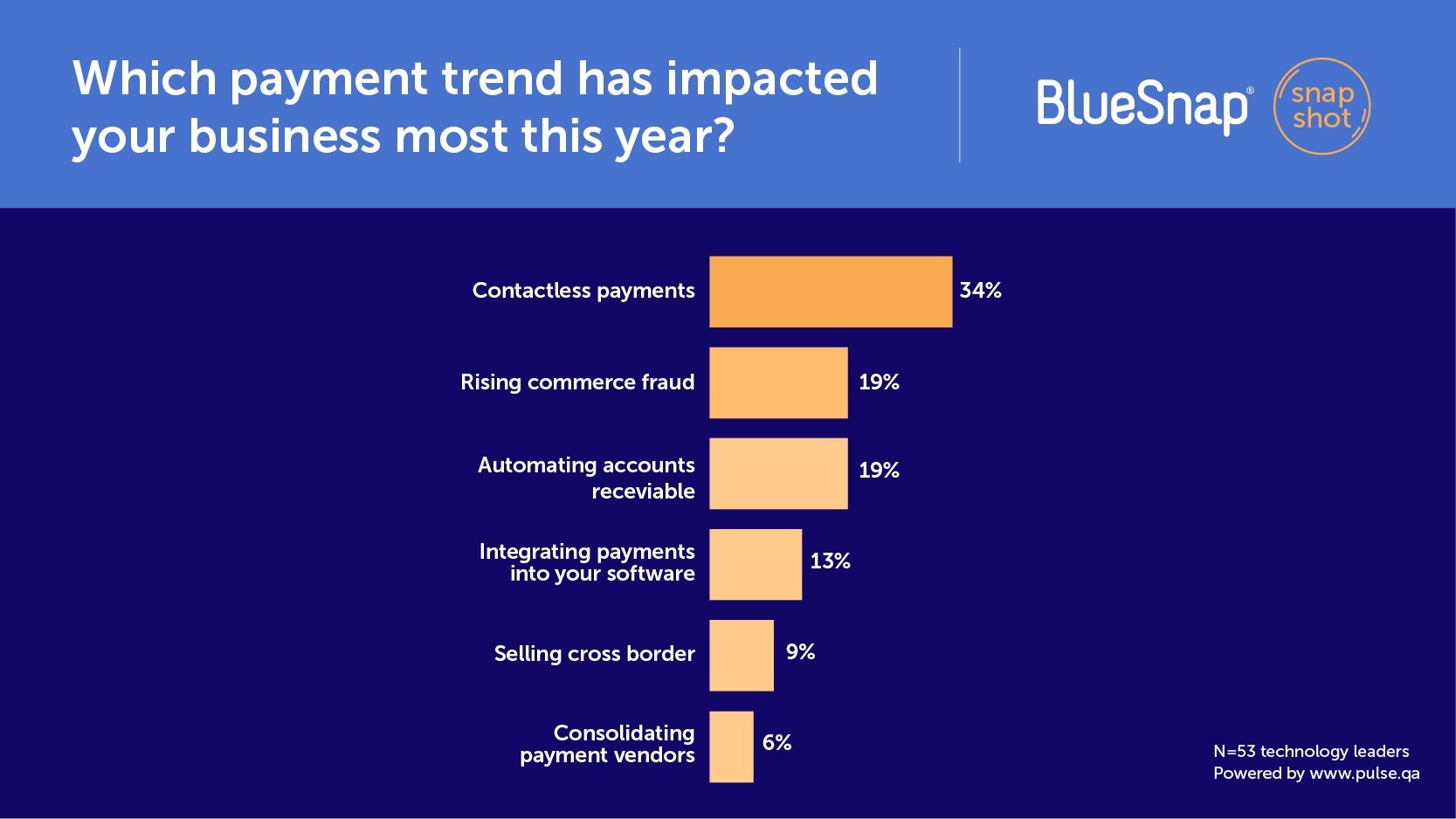

This week, we asked technology leaders around the world which payment trend has had the biggest impact on their companies this year, and the results reinforce how the pandemic has affected businesses.

Over a third of respondents said that contactless payments have had the biggest impact, followed by automating accounts receivable and rising eCommerce fraud (both at 19%) — not surprising as so much more business is now happening online.

Here are the full results:

Want to learn more about these and other 2021 payment trends? Explore them with these resources:

Payment Trends

- Moving Forward: 12 Payment Predictions for 2021

- 5 Payment Trends that Will Shape 2021 As We Navigate the Pandemic

Contactless Payments

- The Pandemic a Year Later: Contactless Payments, B2B Digitalization & More

- The Dawn of Corona-Free Payments, or Why Consumers Need Contactless Payments Now

Rising eCommerce Fraud

- Card-Not-Present Fraud Is on the Rise: 5 Statistics to Prove It

- 4 Tools That Make Payment Risk Management Easy

Automating Accounts Receivable

Integrating Payments into Your Software

- Integrated Payments: Why Platforms Need Them

- It’s Time for Your B2B Company to Join the Payments Business

Selling Cross-Border

Consolidating Payment Vendors

- Have You Outgrown Your Payments Solution?

- How to Minimize Tech Debt & Overhead with the Right Payments Solution