BlueSnap remains committed to providing a superior payment platform for global merchants. Today, we’d like to share some information about how we facilitate our merchants’ reconciliation process. Our conversations with merchants reveal that many payment providers overlook this critical function.

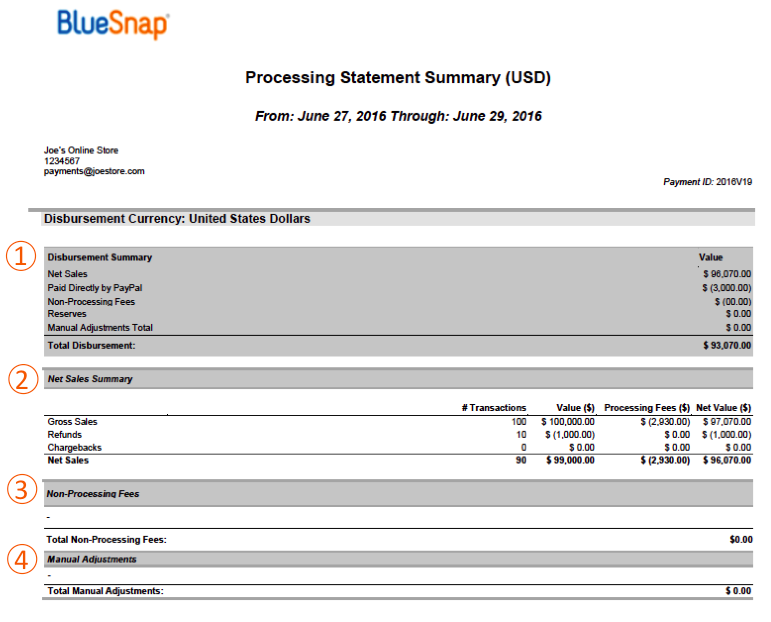

Reconciliation can be especially complex for merchants that receive disbursements from their payment provider in multiple different currencies. A global merchant headquartered in the United States might want CAD transactions sent to a CAD-denominated bank account, EUR transactions to a euro-denominated bank account, and all other transaction currencies deposited into to their USD account. BlueSnap’s processing statements clearly summarize the transaction activity that corresponds to each disbursement. See the example statement for Joe’s Online Store below.

The processing statement has 4 sections. Section 1 reconciles net sales to the amount deposited into the merchant’s bank account, netting out sales paid directly from PayPal, non-processing fees for services such as fraud prevention and account updater, reserves, and manual adjustments (ex. professional services). The next section reconciles gross sales to net sales by deducting refunds, chargebacks, and processing fees. Sections three and four provide detail on non-processing fees and manual adjustments respectively.

The sample statement is for a USD disbursement. However, merchants receive a statement for each disbursement currency. If Joe’s Online Store had also received disbursements in EUR and CAD, he would have processing statements for each of those disbursements.

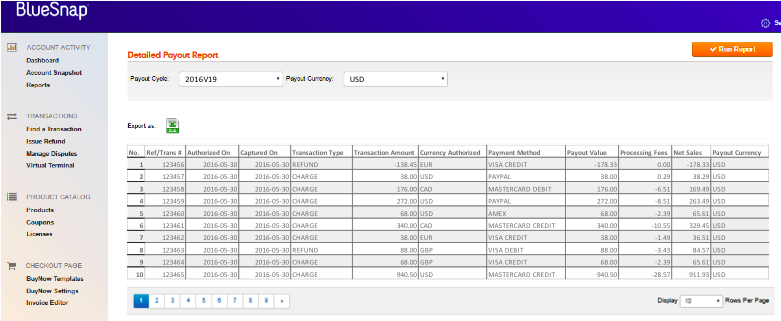

Each processing statement is accompanied by a transaction-level report (officially, a Detailed Payout Report). It includes details on every transaction included in the associated disbursement – transaction number, authorization and capture dates, authorization currency, payment method, gross sale amount, processing fees, and net amount. This report is helpful for transaction-level reconciliation.

As part of your reconciliation, you might also want to see additional order details such as product info, charge type (one-time or recurring charge), shopper info (ID, name, email, country), or custom fields. All of this information is available in the Transaction Detail report. When running this report, you can use the Payment ID parameter to easily retrieve all transactions associated with a particular payout.

Our processing statements, detailed payout reports, and transaction detail reports can all be exported into excel so you can easily import data into your accounting applications. To help merchants automate this process, we recently launched a Reporting API (you can check out the docs in our developer hub here). Currently, it can be used to retrieve the Transaction Detail report. But stay tuned, you will soon be able to retrieve your Detailed Payout.

And if you’re a fan of Zapier like we are, stay tuned for our beta integration so you can automatically import data into hundreds of applications including some of the most common accounting and CRM tools.